IPO Glossary

Understand the meaning of popular words related to IPO.

An IPO is when a private company offers its shares to the public for the first time. It allows the company to raise capital and expand its business operations. Investors can purchase shares, becoming partial owners of the company.

Issuer

An IPO issuer is a company that issues its shares to the public for the very first time. It expects to raise capital through the sale of part of its ownership.

Example: The issuer of the IPO in 2021 for fund-raising towards growth and expansion was Zomato Limited.

Underwriter

An underwriter is a financial institute or investment bank that looks after the entire IPO process. They help the issuer determine the initial price of the shares, acquire them from the issuer, and sell them to the general public. Underwriters assume the risks associated with selling shares.

Example: Kotak Mahindra Capital Company, Morgan Stanley India, and others were the Nykaa IPO 2021 underwriters. They made sure that shares were duly sold to the public.

Draft Red Herring Prospectus or DRHP

DRHP is a preliminary prospectus and the first document submitted by an issuer to the Securities and Exchange Board of India for its approval. It consists of full business operations, financials, and risks associated with the Company's operations, but it excludes final price and issue size.

Example: Paytm filed its DRHP with SEBI in July 2021, divulging detailed information concerning business and financials to probable investors before the IPO.

Red Herring Prospectus (RHP)

It is a final prospectus with price band and issue size, issued after approval from SEBI and before the IPO, to provide relevant information to investors.

For example, Zomato issued its RHP in July 2021 with a price band of Rs 72-76 per share and an issue size of Rs 9,375 crores.

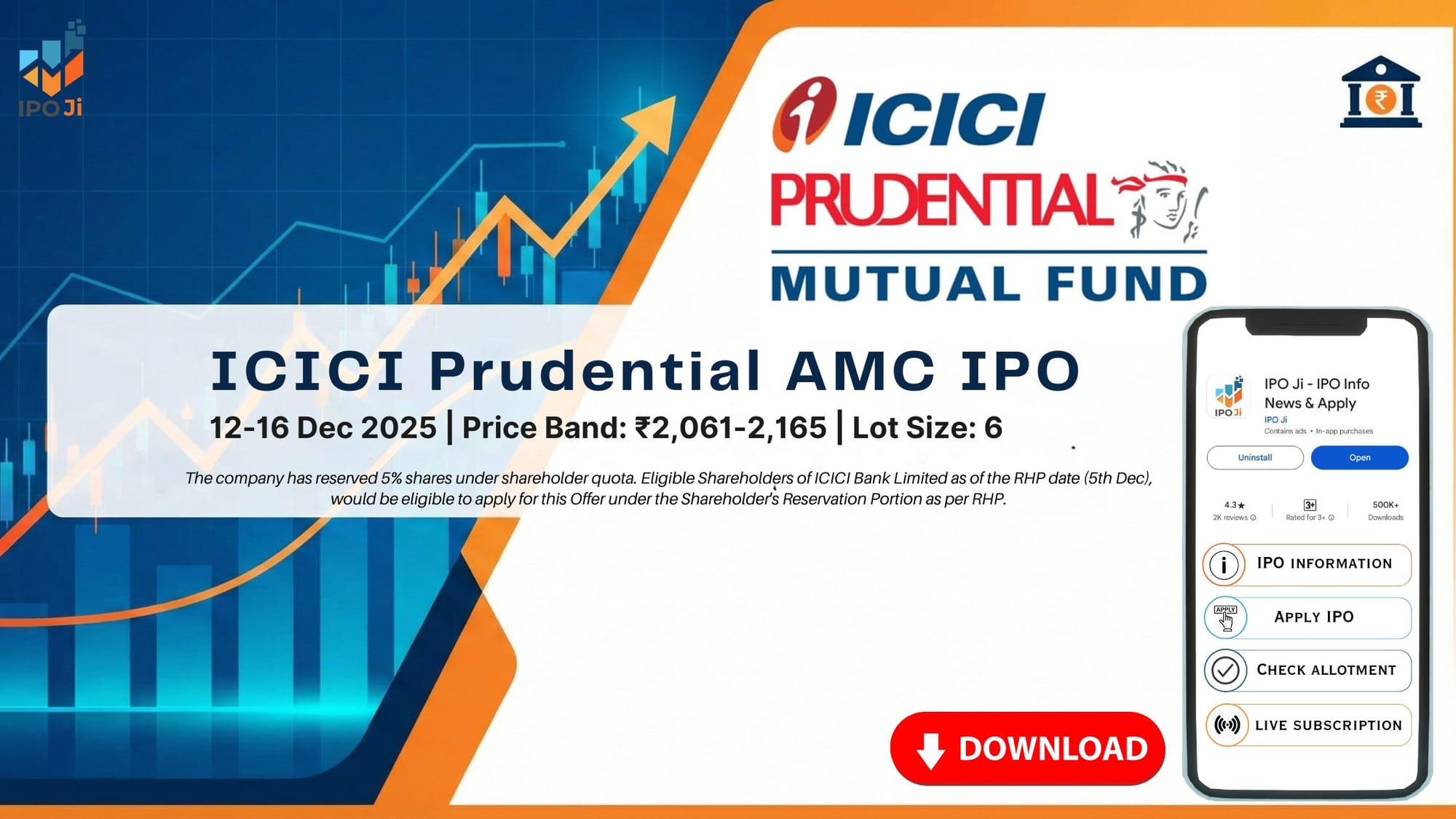

Price Band

The price band is the price range within which the shares are purchased by investors in the case of an IPO. It gets fixed by the issuer and the underwriter, who consider market conditions and demand from investors.

Example: The price band for the 2022 IPO of LIC was fixed at Rs 902-949; investors could bid at any price within that range.

Issue Size

Issue size refers to the total value of shares that an issuer offers through an IPO. Issue size can be calculated by multiplying the number of shares offered by the final offer price.

Example: November 2021's IPO issue size for Paytm was Rs 18,300 crores, the biggest IPO so far floated in India.

Under Subscription

Subscription refers to a situation when the demand for the shares of an IPO is less in comparison to the quantity or number of shares offered. This may result in lower capital than expected raised for the issuing company or entity.

Example: The Coal India IPO in 2010 remained under-subscribed at the end of the second day, only to be bailed out by institutional investors later.

Oversubscription

Oversubscription is when the demand for issued shares through an IPO exceeds its offer. It showcases strong interest from the investor community, which may then result in better listing gains.

Example: The 2008 Reliance Power IPO was subscribed 73 times, which simply pointed out how huge the interest and expectations that the investors had built up from this IPO.

Allotment

Allotment refers to the allotting of shares to shareholders who are applying for share allotment. The allotment may be either in full or partly based on applicants and what exists.

Listing

Listing refers to admitting the company's shares to a stock exchange for trading purposes. In this case, after the IPO, the company's stock will now be made available to be traded among the public, hence making it liquid to its shareholders.

Anchor Investors

Anchor Investor is an institutional investor who is invited to buy the share before the issue opens for public buying. They are expected to create market confidence, and their willingness may influence further demand from retail investors.

Grey Market

Grey market is generally an unofficial market that deals in shares when such shares have not yet been listed on the official stock exchange. The prices quoted in the grey market may be indicative of future performance, but the nature of this business is unregulated and speculative.

Cut-off Price

This is the final price at which shares are issued to retail investors in a book-building IPO. Retail investors can opt to bid at the cut-off price, that is, they agree to accept the final price as decided through book-building.

Book Building

The company determines a price range, also called the price band for its shares; and then the investors bid at the price they desire in the given range. Accordingly, based on those bids, the final issue price is determined to provide a fair market price to the shares.

Underwriter

Underwriters are financial institutions, typically investment banks, which handle the IPO process. They help determine the issue price and promote shares. They ensure that the IPO is successful. Underwriters also buy any shares that are left unsold.

Lock-up Period

This is referred to as the IPO lockup period, often between 90 to 180 days after the IPO, where insiders (executives, and employees) are not allowed to sell their shares. This prevents sudden crashes in stock prices due to large-scale selling.

Flipping

Flipping refers to the act of buying shares during an IPO and selling them near the listing date to reap the gains from the price increase. This is a highly speculative strategy because it largely depends on the short-term market performance of the security.